Dividend-paying international stocks have often contributed to some investors’ total returns and served as a source of potential income from and diversification within an investment portfolio. We believe successful international dividend investing requires a careful approach: one that pursues attractive yields while avoiding the risks associated with international dividend investing.

In this paper, we offer a closer look at some of those risks. We then explain the methodology the underlying index uses that the FlexShares International Quality Dividend Index Fund (IQDF) tracks in an attempt to invest in stocks with dividend yields1 that are both high and sustainable.

THE CHALLENGES OF INTERNATIONAL DIVIDEND INVESTING

For decades, investors have looked beyond price appreciation to stock dividends as another source of return in their equity portfolios. In recent years, persistently low international interest rates have made dividend income even more valuable as investors have sought an income-producing alternative to traditional fixed-income investments.

For decades, investors have looked beyond price appreciation to stock dividends as another source of return in their equity portfolios. In recent years, persistently low international interest rates have made dividend income even more valuable as investors have sought an income-producing alternative to traditional fixed-income investments.

As dividend income becomes more important to investors’ overall portfolios, it’s critical to avoid common risks that can threaten their dividend income stream. It can be tempting to simply choose international stocks with the highest dividend yield in an effort to boost a portfolio’s total return and income potential—but those high yields may come with higher risks.

Primarily, investors must avoid so-called “dividend traps.” High international dividend yields often result from falling stock prices, either due to company- or country-specific financial challenges or to broader market and macroeconomic threats. Those problems may be exacerbated for a U.S. investor due to lack of familiarity with the individual country’s marketplace. U.S. investors may be surprised when the problems cause companies to reduce or suspend their future dividends, undercutting the expected benefit U.S. investors look for from dividend-paying equities. What’s more, international dividend-paying stocks may be concentrated in specific countries, sectors and industries, so focusing on them may lead to portfolios that are under-diversified and overweight in those particular areas.

Primarily, investors must avoid so-called “dividend traps.” High international dividend yields often result from falling stock prices, either due to company- or country-specific financial challenges or to broader market and macroeconomic threats. Those problems may be exacerbated for a U.S. investor due to lack of familiarity with the individual country’s marketplace. U.S. investors may be surprised when the problems cause companies to reduce or suspend their future dividends, undercutting the expected benefit U.S. investors look for from dividend-paying equities. What’s more, international dividend-paying stocks may be concentrated in specific countries, sectors and industries, so focusing on them may lead to portfolios that are under-diversified and overweight in those particular areas.

In our view, the key to successful international dividend investing is to focus not just on high dividend yields, but on sustainable dividend yields—in other words, dividend payments that are likely to continue in the future.2 To do that, investors should consider a two-pronged approach:

THE FLEXSHARES SOLUTION: MEASURING INTERNATIONAL DIVIDEND QUALITY IN EVERY MARKET SECTOR

The FlexShares International Quality Dividend Index Fund (IQDF) is an ETF that seeks to avoid common risks associated with international dividend investing by tracking a custom index, The Northern Trust International Quality Dividend Index3. Northern Trust Investments Inc. (NTI) is the investment adviser for FlexShares ETFs.

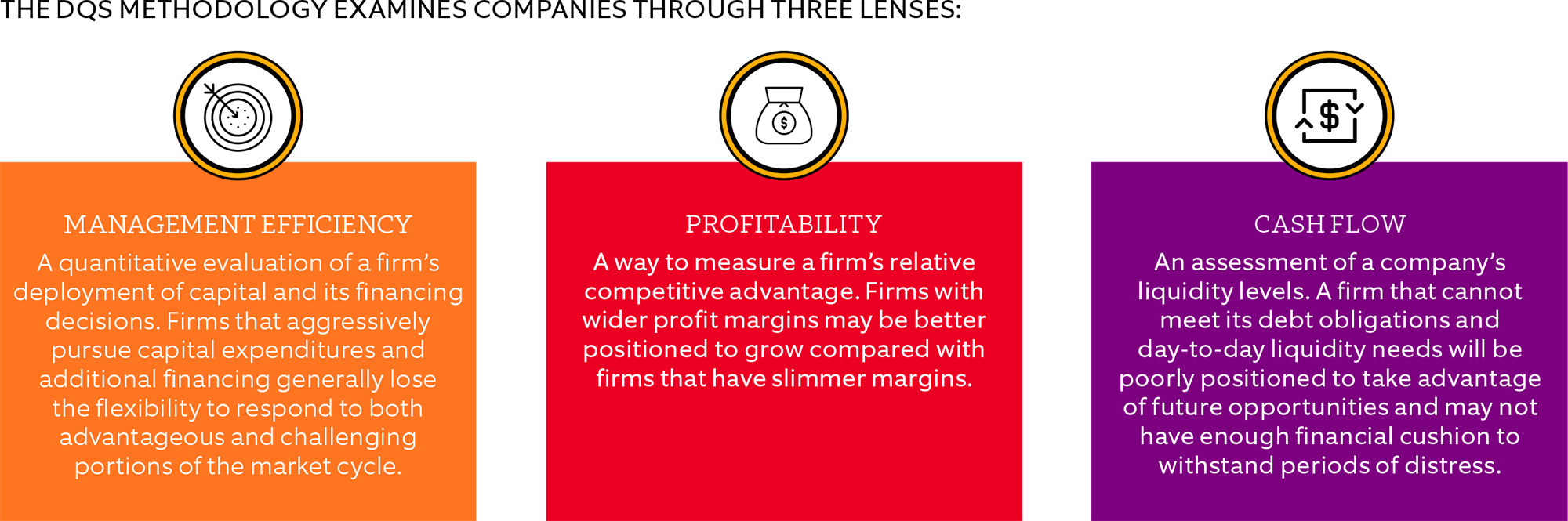

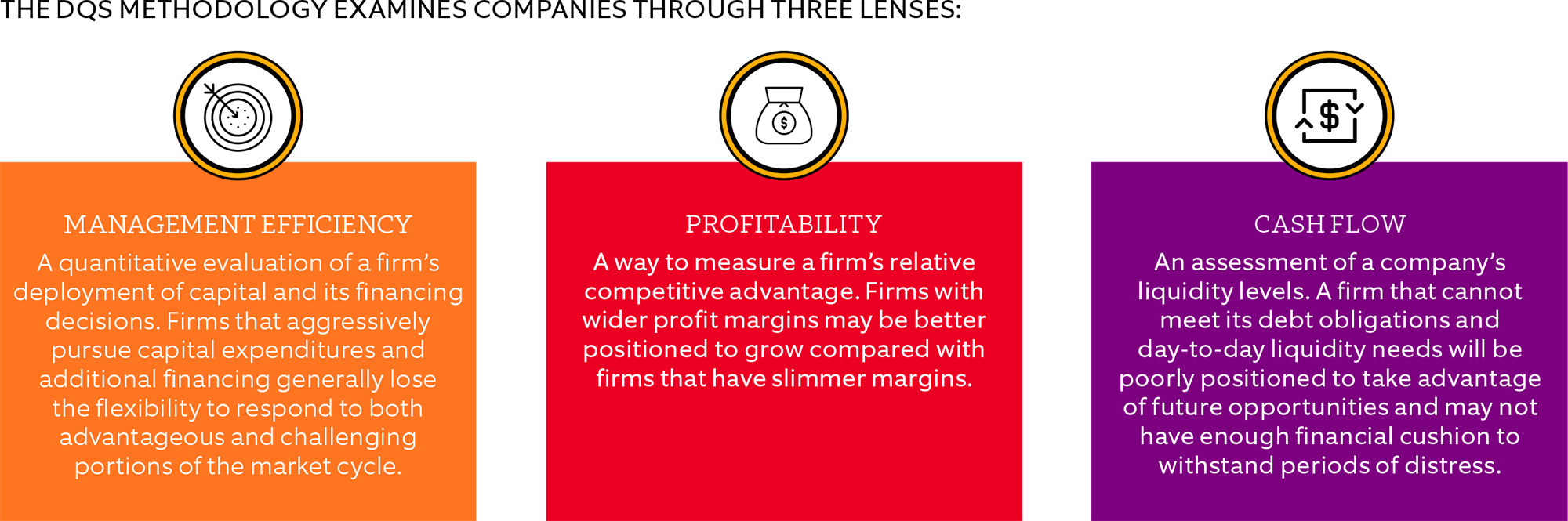

Starting with the Northern Trust Global Index4, which represents 97.5% of world’s float adjusted market capitalization and encompassing both developed and emerging markets worldwide, NTI first begins by pulling in all eligible securities. Securities are then grouped by their developed and emerging market classifications, with the developed market securities sorted further by their full market capitalization while eliminating all non-dividend paying stocks. Additional index size thresholds are then derived at the developed market and emerging market group levels. Then, they apply a multi-faceted Dividend Quality Score (DQS) to measure a company’s core financial health and evaluate whether it may increase (or decrease) its future dividends.

The DQS score evaluates dividend-paying equities across all these lenses and ranks companies in each sector. This approach helps ensure an “apples-to-apples” comparison because different financial characteristics may be appropriate in different sectors. It also identifies quality companies in every sector, supporting diversification in the initial index construction process.

NTI ranks all stocks in a sector by DQS score and divides the list into quintiles, with quintile 1 comprising the highest-ranked companies and quintile 5 comprising the lowest-ranked firms. The index eliminates all stocks in quintile 5, and then diversifies holdings according to rules such as maximum overweights/underweights for individual stocks, countries, sectors and industries.

HARNESSING QUALITY AND YIELD FOR GREATER CONFIDENCE

The DQS approach to underlying index construction recognizes the real-world goals behind international dividend investing strategies—namely, to generate sustainable income from a portfolio, help improve diversification and to harness the long-term return potential of international dividend-paying stocks.

This rules-based, repeatable process is designed to help avoid dividend traps and sector biases. Evaluating a company’s financial health through several lenses and ranking them with other companies in their sectors/industries can provide a strong sense of how well-positioned a dividend-paying company may be for success—and how protected future dividends could be.

This approach doesn’t assume that past dividend history is an indicator of continued high dividend yields. And by relying on publicly available financial data, relatively new dividend-paying international companies can be evaluated alongside stocks that have paid dividends for years. Our research suggests that the most important characteristic of each stock held in the FlexShares International Quality Dividend Index Fund (IQDF) is that the company has a solid economic foundation to support future dividend payments.

CONCLUSION

While international dividend investing is for some investors a well-established equity investment strategy, blindly pursuing international stocks with the highest dividend yields may be dangerous in the long run. High dividend yields may mask underlying problems—such as weak stock prices due to poor financial performance—that could result in lower future dividend payments.

The FlexShares International Quality Dividend Index Fund (IQDF) helps investors avoid common risks of dividend investing by selecting stocks with both high dividend yields and strong underlying fundamentals. We believe this quality-focused approach offers a method for pursuing an international dividend investing strategy that emphasizes sustainable dividend yields to help meet investors’ goals for income, diversification and total return.

FOOTNOTES

1 Dividend yield is a financial ratio that indicates how much a company pays out in dividends each year relative to its share price. Dividend yield is represented as a percentage and can be calculated by dividing the dollar value of dividends paid in a given year per share of stock held by the dollar value of one share of stock.

2 Dividends represent past performance, and there is no guarantee they will continue to be paid.

3 The Northern Trust International Quality Dividend Index is designed to provide exposure to a high-quality income-oriented universe of long-only international securities issued by non-U.S.- based companies, with an emphasis on long-term capital growth and a targeted overall beta that is similar to that of the Northern Trust International Large Cap Index (the parent index). Companies that are included in the index are selected based on expected dividend payment and fundamental factors such as profitability, management expertise, and cash flow.

4 The Northern Trust International Large Cap Index’s eligible universe represents all securities in the Northern Trust Global Index, designated as Large/Mid-Cap, with the exception of securities domiciled in the United States. The Northern Trust Global Index is designed to track the performance of the global investable equity markets covering approximately 97.5% of world’s float adjusted market capitalization. The Index’s coverage encompasses both developed and emerging markets worldwide.