Population growth and rising incomes in the developing world have increased demand for energy, food products, metals and other natural resources, including water. Rising demand can potentially mean rising prices for the stocks of companies involved in natural resources sectors. This situation may create potential opportunities for investors, but we believe some parts of the supply chain offer greater potential upside than others. At the same time, a natural resources investment strategy may be prone to overconcentration in some industries such as energy.

In this paper, we explain how an investment strategy focused on companies involved in the upstream components of the natural resources supply chain may capture the favorable growth and price impacts of rising demand. We then explain the methodology the FlexShares Morningstar® Global Upstream Natural Resources Index Fund (GUNR) uses to help avoid sector concentration that may skew overall exposures and performance.

CAPTURING PRICE AND GROWTH IMPACTS IN NATURAL RESOURCES

We believe that demand for natural resources is expected to increase for an extended period due to growing populations and rising per-capita income in global markets. Adding exposure to natural resources investments provides a possible opportunity to capitalize on the potential benefit of rising natural resource product prices. The market forces producing these opportunities may also create the potential to offset some of the longer-term inflationary effects of economic expansion in emerging and established regions.

We believe that demand for natural resources is expected to increase for an extended period due to growing populations and rising per-capita income in global markets. Adding exposure to natural resources investments provides a possible opportunity to capitalize on the potential benefit of rising natural resource product prices. The market forces producing these opportunities may also create the potential to offset some of the longer-term inflationary effects of economic expansion in emerging and established regions.

Investors have several considerations to assess when choosing a natural resources investment strategy. For example, in each category, companies may operate in either the upstream or downstream portion of the supply chain. Upstream companies sit at the start of the supply chain and produce or extract resources that are then transported to processors. Downstream companies process natural resources into consumer goods.

Downstream companies may face complexities and costs related to packaging, distribution, marketing, branding and other factors that can affect profitability and cash flows. By contrast, upstream companies can be less complex because their costs lie mainly in resource extraction, with minimal processing and delivery to downstream companies. Upstream companies also may benefit from raw material price increases, while downstream companies, which must pay those higher prices for their input materials, may experience negative impacts.

Another consideration is that some natural resources strategies can lead to overcon¬centration in industries such as energy and metals, due to their prominence in global financial markets and the macro-economy. Our theory is that this bias may limit exposure to three sectors including agriculture, timber and water, making it difficult to construct a well-balanced portfolio.

THE FLEXSHARES SOLUTION: A BALANCED PORTFOLIO OF UPSTREAM NATURAL RESOURCE COMPANIES

The FlexShares Morningstar Global Upstream Natural Resources Index Fund (GUNR) is an ETF that seeks to provide investors exposure to the potential rising demand for natural resources by tracking the Morningstar Global Upstream Natural Resources Index.1

The FlexShares Morningstar Global Upstream Natural Resources Index Fund (GUNR) is an ETF that seeks to provide investors exposure to the potential rising demand for natural resources by tracking the Morningstar Global Upstream Natural Resources Index.1

The universe of stocks available for consideration in the index starts with the Morningstar Global Ex-US Index2 and the Morningstar US Market Index.3 The index then screens for companies that meet its classification standards for inclusion in the energy, agriculture, precious or industrial metals, timber and water resources sectors.

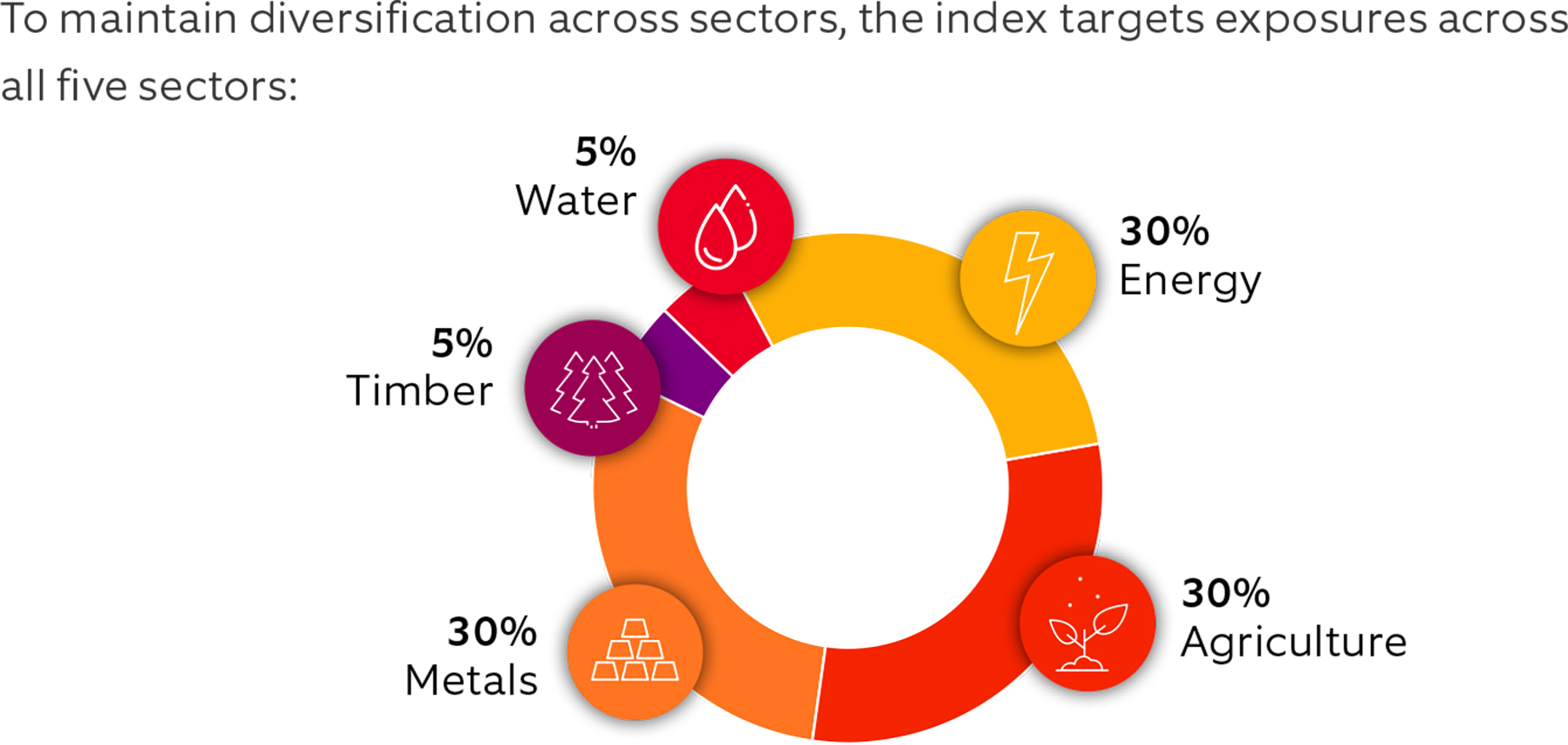

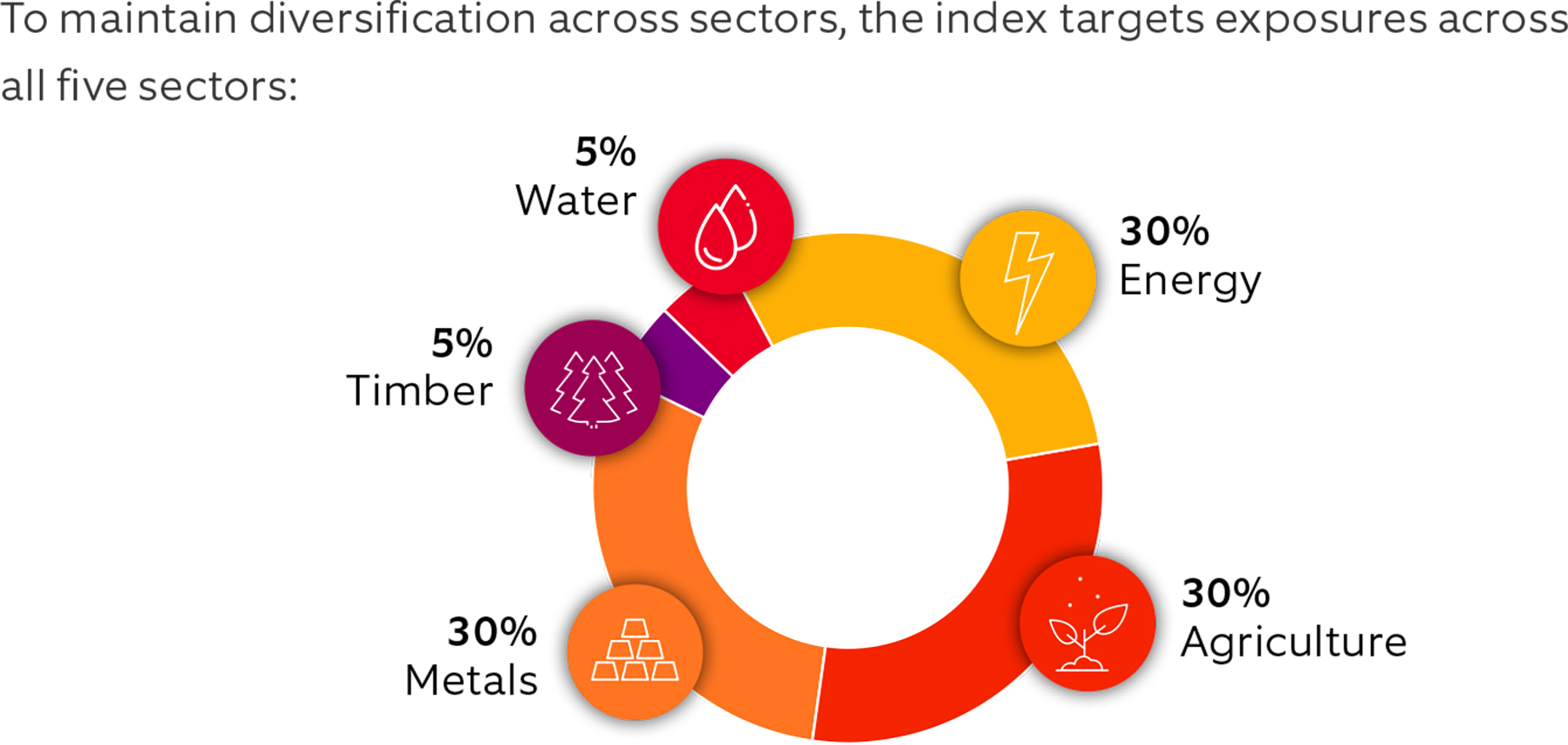

To maintain diversification across sectors, the index targets exposures across all five sectors:

For further diversification, the index applies regional constraints, capping exposure to emerging markets at 20% and exposure to U.S. securities at 40%. In addition, the final portfolio caps exposure to any single security at 5%.

UPSTREAM EXPOSURE WITH SECTOR AND REGIONAL DIVERSIFICATION

Our research suggests an index focused on exposure to natural resources compa¬nies operating in the upstream portion of the supply chain may reduce complexity and may offer more potential benefit from rising demand for natural resources. Downstream companies, by contrast, we believe have historically been negatively affected by rising resource prices.

Our research suggests an index focused on exposure to natural resources compa¬nies operating in the upstream portion of the supply chain may reduce complexity and may offer more potential benefit from rising demand for natural resources. Downstream companies, by contrast, we believe have historically been negatively affected by rising resource prices.

Dedicated core investments in timber and water resources also may provide balance and help protect against overconcentration in areas such as metals or energy, which we believe tend to be dominated by large global companies. Targeted exposures by sector may further help avoid any single natural resources sector from dominating or skewing overall exposures and performance. At the same time, regional constraints may help produce a global portfolio balanced across the U.S., other developed countries and emerging markets.

CONCLUSION

While we believe population growth and rising income have generated investment opportunities in natural resources, those opportunities may not be equally distributed throughout the supply chain. Furthermore, the disparities in the relative size of companies within different natural resources sectors can create a risk of overcon¬centration in energy or metals, potentially skewing overall returns.

The FlexShares Morningstar Global Upstream Natural Resources Index Fund (GUNR) seeks to provide investors focused exposure to companies more likely to benefit from favorable growth and price impacts generated by rising global demand for natural resources. The Fund’s emphasis on the upstream portion of the supply chain may help to increase an investor’s exposure to the positive impact of rising prices. At the same time, its diversification across sectors and regions may help mitigate the risk of skewed concentrations in sectors with a greater economic footprint. We believe this approach offers investors an opportunity to participate in the rising global demand for natural resources while maintaining a balanced position across emerging and established regions.

FOOTNOTES

1. Morningstar Global Upstream Natural Resources Index measures the performance of stocks issued by companies that have significant business operations in the ownership, management and/or production of natural resources in energy, agriculture, precious or industrial metals, timber and water resources sectors as defined by Morningstar’s industry classification standards.

2. The Morningstar Global Ex-US Index is a weighted index designed to capture the broad performance of stocks located in the developed and emerging countries around the world.

3. The Morningstar US Market Index is a diversified broad market index that targets 97% market capitalization coverage of the investable universe of US stocks.