Companies face growing pressure from regulators and investors to address concerns such as climate change, worker health and safety, and diversity and inclusion. A growing body of research is showing that how they manage these issues is likely to have a material impact on their balance sheets, income statements and share prices.

Companies face growing pressure from regulators and investors to address concerns such as climate change, worker health and safety, and diversity and inclusion. A growing body of research is showing that how they manage these issues is likely to have a material impact on their balance sheets, income statements and share prices.

Demand for Environmental, Social and Governance (ESG)1 strategies is surging

Investors are increasingly aware of these issues as well. Many want to align their investment strategies with their values; many are coming to recognize that ESG can be a critical driver of portfolio performance as well. While they want to capitalize on opportunity, they also want to manage their ESG-related investment risks.

To date, however, it’s been difficult for investors to find core equity and fixed-income strategies that take a consistent approach to incorporating ESG.

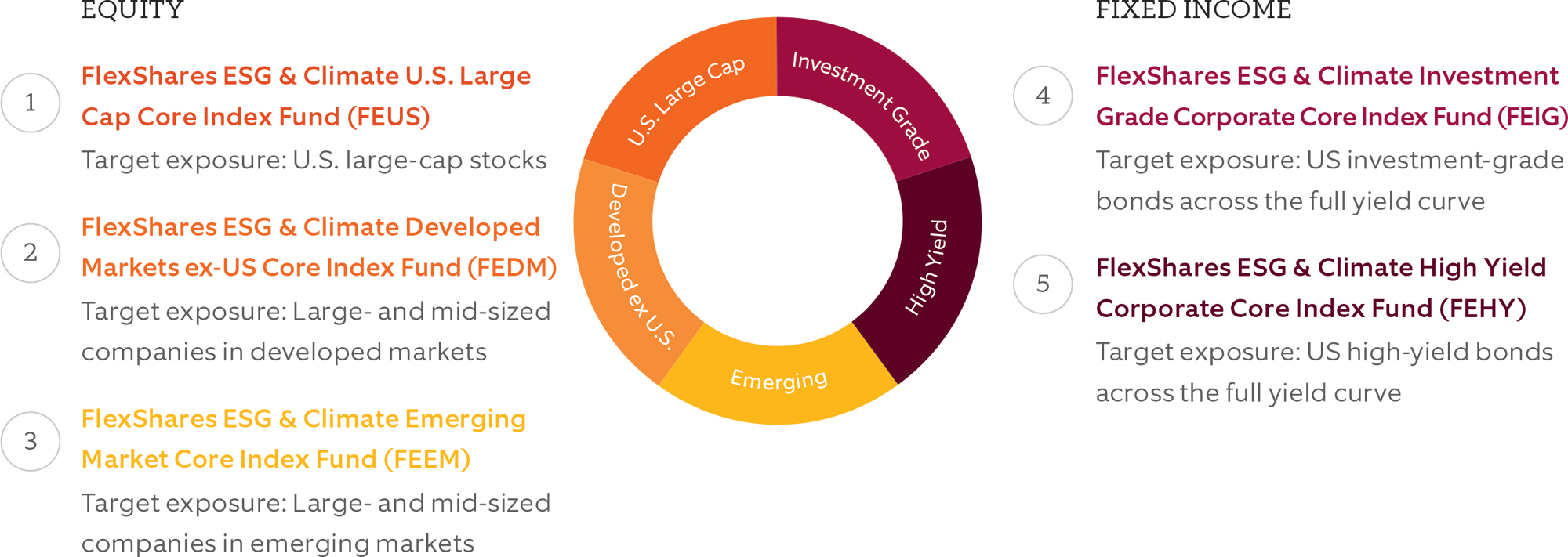

That’s why FlexShares has developed a new suite of ESG-oriented ETFs. Each of the four funds targets a different core equity or fixed-income asset class. All employ our sophisticated, proprietary risk-assessment methodology to seek an overall improvement in the portfolio’s ESG score, with additional emphasis on reducing carbon risk versus the benchmark. These improvements are designed to have minimal tracking error2, so they can help deliver the market exposures that investors expect from their core investments.

A DELIBERATE SCORING METHODOLOGY

Growing interest in sustainable investing has spawned a range of new ESG data sets. But variations in criteria creates a confusing and inconsistent mix of ratings. One data provider may rank a particular company as a sustainability leader, while another provider gives the same company a lower score. To offer a consistent measure of sustainability, FlexShares’ core ESG ETFs use the new ESG Vector Score developed by Northern Trust Asset Management — the investment advisor for FlexShares ETFs.

We offer an overview of the scoring methodology that FlexShares uses to assess companies’ financially relevant sustainability issues based on their sector and industry, as well as the degree of carbon risk individual companies carry. We then explain the portfolio construction process that helps us pursue material improvements in ESG ratings and carbon risk, while maintaining core equity and fixed-income exposures

We offer an overview of the scoring methodology that FlexShares uses to assess companies’ financially relevant sustainability issues based on their sector and industry, as well as the degree of carbon risk individual companies carry. We then explain the portfolio construction process that helps us pursue material improvements in ESG ratings and carbon risk, while maintaining core equity and fixed-income exposures

The ESG Vector Score is designed to focus on ESG-related business issues most likely to impact a company’s financial performance — and ultimately, a portfolio’s investment return. Our scoring methodology employs a framework established by the Sustainable Accounting Standards Board (SASB), that identifies 26 categories of general sustainability issues that affect company performance. Then, SASB determined which of those issues are most relevant to a particular sector or industry.

- By identifying material issues within specific sectors and industries, we can assess risks facing one company that are not applicable to another. For example: Food retailers and distribution companies may have higher risks related to product labeling and labor practices.

- Energy and utility companies typically face higher risks related to carbon emissions.

- Financial companies have higher risk around issues of data security.

Because our scoring methodology specifically addresses the potential financial health of a company, it’s applicable across both equity and fixed-income strategies.

HISTORICALLY AWARE AND FORWARD-LOOKING

While SASB scoring helps measure a company’s historic performance on sustainability issues, our methodology also considers how a company’s ESG risk may change in the future. This forward-looking assessment, is adapted from the thematic framework developed by the Task Force on Climate-Related Disclosures (TCFD). The TCFD framework measures key elements around governance, reporting, strategy and risk assessment to help determine how effectively a company is managing its carbon-related risks. Northern Trust Asset Management adapted that framework to cover all financially material sustainability issues identified by SASB.

We believe this approach offers a transparent, consistent and actionable way to identify sustainability leaders. We can differentiate between two companies with similar ESG scores by examining which company is better positioned, and demonstrably committed, to manage material sustainability risks in the future. The goal is to identify and mitigate sustainability risks before they impact the company’s financial statements — and the portfolio’s performance.

ADDRESSING THE ECONOMIC IMPACT OF CLIMATE CHANGE

We appreciate that climate change is a top concern among many companies, investors and regulators around the world. Each strategy in our core ESG ETF suite incorporates a special focus on carbon risk in addition to other components of the overall ESG score.

The ISS carbon risk rating methodology measures a company’s carbon emissions as well as the specific carbon- and climate-related challenges.

We’ve partnered with Institutional Shareholder Services (ISS), a leading provider of ESG data specializing in carbon risk. The ISS carbon risk rating methodology measures a company’s carbon emissions as well as the specific carbon- and climate-related challenges — physical, financial, regulatory and technological — that represent material risks to a company’s operations and long-term performance.

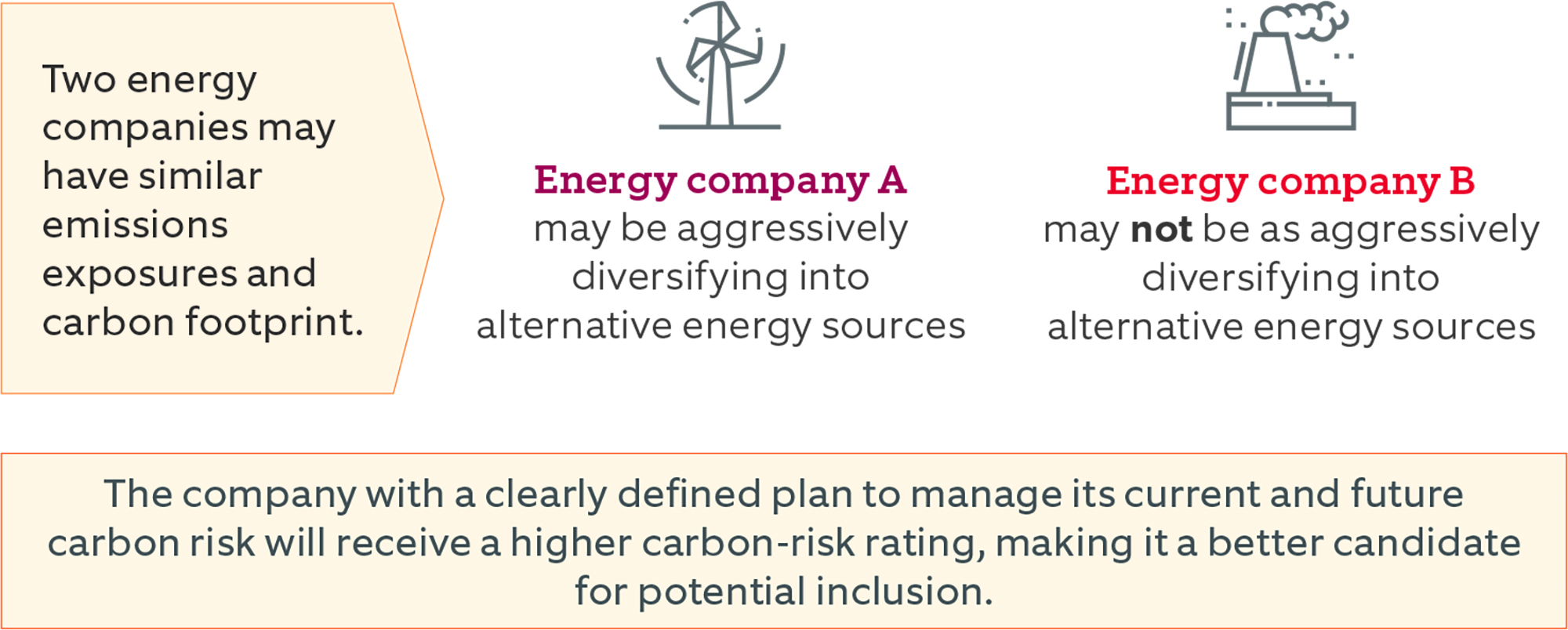

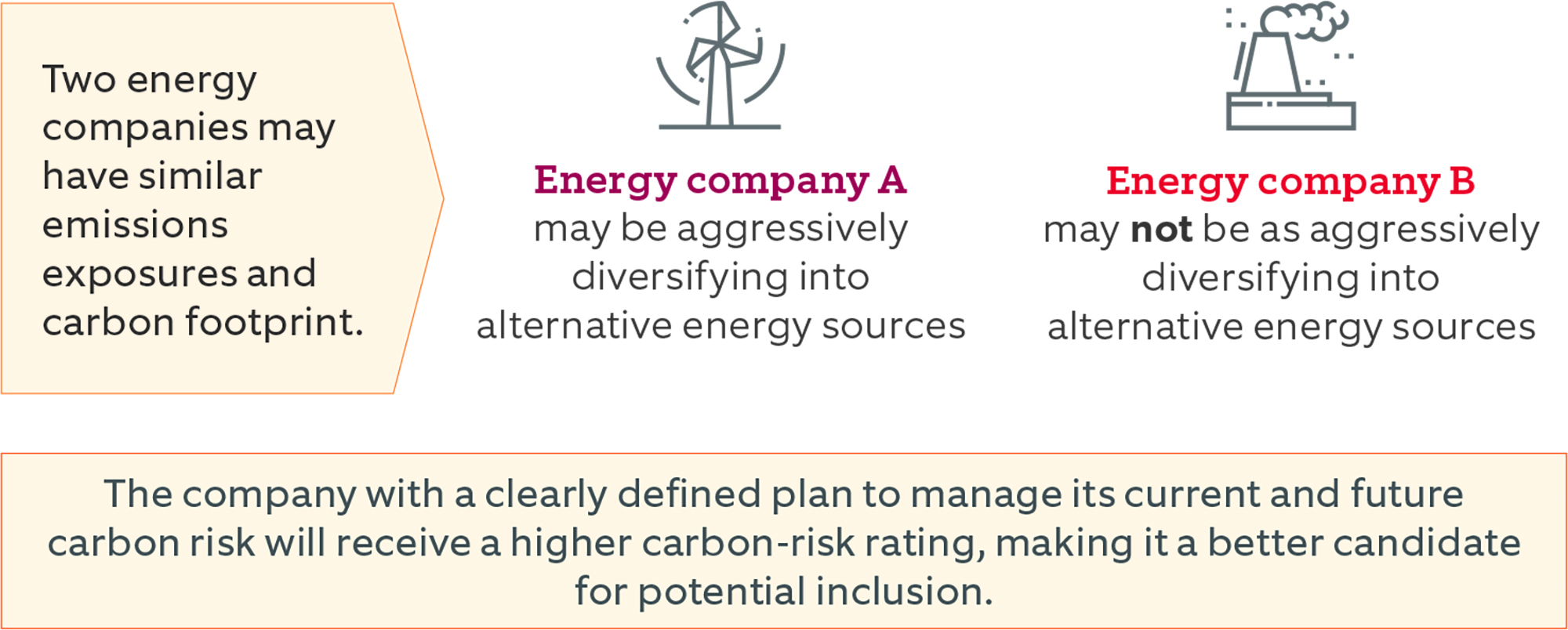

Like the SASB’s framework that identifies financially material sustainability issues for each sector, ISS examines each company’s carbon emissions, efforts to reduce its carbon footprint, and potential exposure to carbon-risk relative to other companies in its industry. These sector/industry-specific ratings inform a detailed analysis on the holdings we select for our strategies. For example:

Thanks to the measurability of carbon exposure, each strategy in our core ESG ETF suite is able to target a 50% reduction in aggregate carbon emissions and carbon reserves relative to its respective benchmark, while also targeting an overall improvement in carbon risk rating.

We believe this approach will deliver core investing strategies that are better positioned to benefit from the ongoing transition to a low-carbon economy.

10 YEARS OF DISCIPLINED PORTFOLIO CONSTRUCTION

Over the past decade, we’ve refined our disciplined, systematic approach to serve a broad range of investment objectives — such as reducing volatility or providing high dividend yields — while balancing desired exposures to investment factors such as size, value and momentum.

Now, we are applying FlexShares’ quantitative investing expertise to incorporate ESG objectives in core strategies while maintaining market-like exposure.

Here is how we do it: